DRIVING MOBILE PAYMENTS, DIGITAL CONTENT & ADVERTISING

Connect with the leading innovators in mobile payments, digital content, and advertising

Join the World Telemedia event in Marbella, October 5-7, 2025

This is your chance to meet face-to-face with key players and drive your business forward. Experience three days of dynamic networking, valuable insights, and unparalleled business opportunities. Get their solutions directly onto your customer devices and increase engagement, conversion, on-boarding and content monetisation.

World Telemedia represents the absolute “sweet spot” – where the mService value chain clicks. Make sure you’re at the very centre of this uniquely energised crowd and book your all-inclusive event pass today.

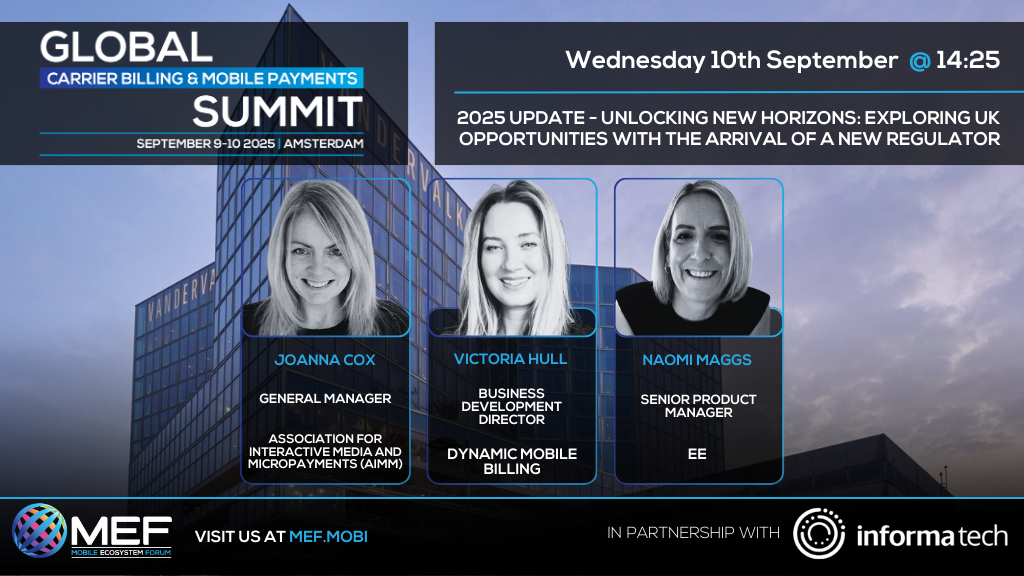

aimm are pleased to be supporting and speaking at this years Marbella event. Come and listen to our talk about the opportunities that are now opening up in the UK market with a new Regulator at the helm. You can find us on Tuesday 7th at 14:00 at Level 1, Studio 1 discussing – UK Market Focus – Open for Business

Hear from the most influential companies in the telemedia ecosystem and discover how to maximise ROI in the right markets, with the right products and services.

The conference includes talks on Business Management, covering topics such as:

- CRM & the cost of complaints

- Customer flows

- Legal issues & regulation

- Performance marketing issues

- MNO’s

- Refunds & debt recovery

- Optimising global advertising

Business Development area will focus on strategies for growth and look at areas such as:

- DCB market research / data

- New Verticals for content & Apps

- Retail & e-money

- Messaging Opportunities

- Ticketing, Vouchers & Couponing

- 5G & The Consumer

- New Markets for Voice

The conference will also include product and service demos. Hear from market leaders as they present a “deep dive” into the latest products and service that you should be signing up for at the show.

- Integrating New Technologies

- Monetisation Strategies

- Content / Service Innovations

- Data Analytics

- Engagement & Retention

- Marketing & Advertising Platforms