Key insights from this years’ Global Carrier Billing & Mobile Payments Summit in Amsterdam

Joanna Cox, General Manager of AIMM, gives her takeaways and insights from the expert panels she was on, at the Global Carrier Billing & Mobile Payments Summit this month.

Panel 1 – Redefining Compliance: From Reactive Policing to Proactive Design

This panel – representing 5 unique territories from across the globe – discussed the shifting compliance landscape, where checks ‘at the door’ are becoming more commonplace, enabling a culture of trust and certainty from the start of every partnership.

No longer an irritating by-product of the carrier billing lifecycle, compliance is now front and centre when designing products and services where the cost is added to your phone bill.

In the current climate, regulators set the rules, watch the market and then evolve the rules as required to safeguard consumers and businesses alike. Alongside this, Trade Associations are being used to demystify the changing regulations and facilitate frameworks around them, to enable businesses to operate effectively whilst staying compliant. AIMM continues to work closely with the industry regulators, to be on the forefront of these changes. Ensuring that members’ collaborative views on regulation are heard, while we simultaneously keep our members updated of important and necessary regulation changes as they happen.

Businesses are now carefully choosing best in show partners, and delivering excellent experiences, to delight their customers – bringing repeat business and showing a direct correlation between compliance and commercial opportunity.

Industry growth is important and the panel explained that where there are negligible complaint numbers, it follows that consumer trust is at an all-time high and can be built on, which is worth celebrating.

In terms of a proactive approach to future compliance, it was agreed that a passive approach will no longer work. Industry needs to stay alert, watch for themes of concern and get ahead of them.

If you’re proven to be operating at the highest level, for the benefit of consumers, those who make the rules will listen when you have something to say. Proactive compliance means that you’ll make your voice heard.

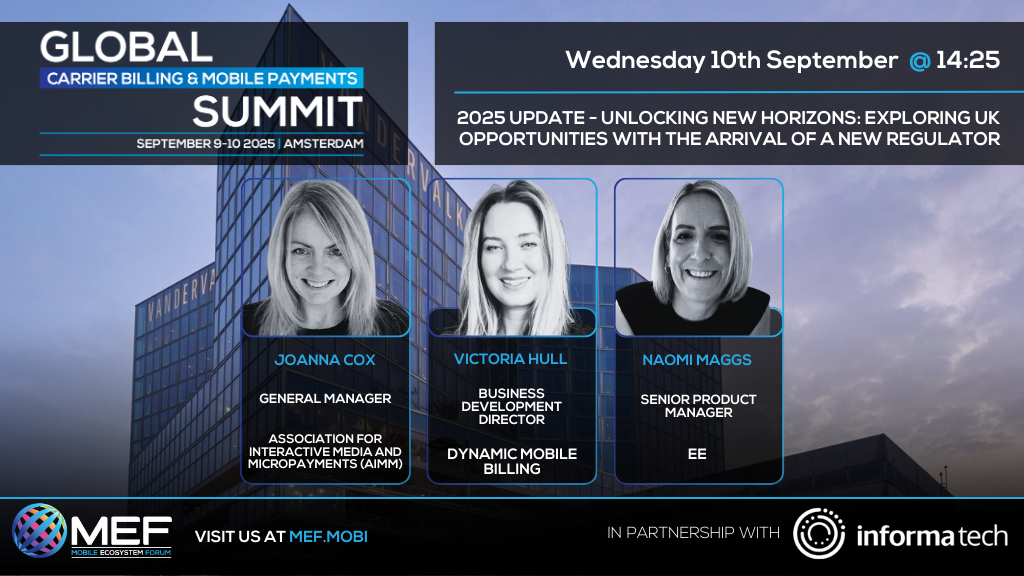

Panel 2 – Unlocking New Horizons: Exploring UK Opportunities with the Arrival of a New Regulator

The UK centric panel – which consisted of a UK MNO, an Aggregator and a Trade Association – focused on changes to the UK regulatory framework since the Summit last year. The new industry regulator, Ofcom, who succeeded the PSA earlier this year, now has overall responsibility for setting the rules for Premium Rate Services in this territory.

The panel discussed the changes that have occurred since the start of the year, highlighting risk management and the appointment of a Generally Authorised Person for every business as key areas of importance.

Obligations around consumer protection, customer care and vulnerable persons, as well as the process of getting systems in processes in place to be compliant – and the order of doing so – before going live – was explained to the audience.

The UK market is dedicated to offering consumers a great experience, and that starts with awareness of carrier billing. The group discussed what understanding consumers have of the process of carrier billing, and shared details of a new aimm Working Group to be launched this Autumn, chaired by Naomi Maggs from EE; which will be dedicated to educating consumers about these payment services, answering their questions and giving advice in how to better use carrier billing with confidence.

The panel reiterated that for any businesses interested in entering the UK market, there couldn’t be a better time to get involved. The rules are clear, the regulator can be easily understood and there are a wealth of people who can help get the process started for you.

Alongside that, your Trade Association and Aggregator are both available to help make the process of offering your products and services to an audience in the UK quicker and smoother.