Vodacom, SA’s leading network has taken a major step forward in mobile user safety by partnering with cybersecurity for mobile payments company, Evina.

Mobile users in Africa’s most advanced economy will now join the ranks of the tens of millions of consumers globally that are protected daily by Evina’s payments technology.

In recent years, the South African mobile industry has attracted a large number of fraudsters leading to a substantial increase in user complaint rates. These frequent fraudulent attacks are due to the fact that a large number of the African population uses a cellular phone, especially as a mobile payment method. Fraudsters are never far from where mobile transactions are. In South Africa alone, the country fraud rate recorded by Evina’s fraud sensors was 23.53% with clickjacking being the most fraudulent technique used to defraud mobile users in the first quarter of 2021. This region is a playground for new and extremely sophisticated fraud techniques that are difficult to spot unless using advanced technology

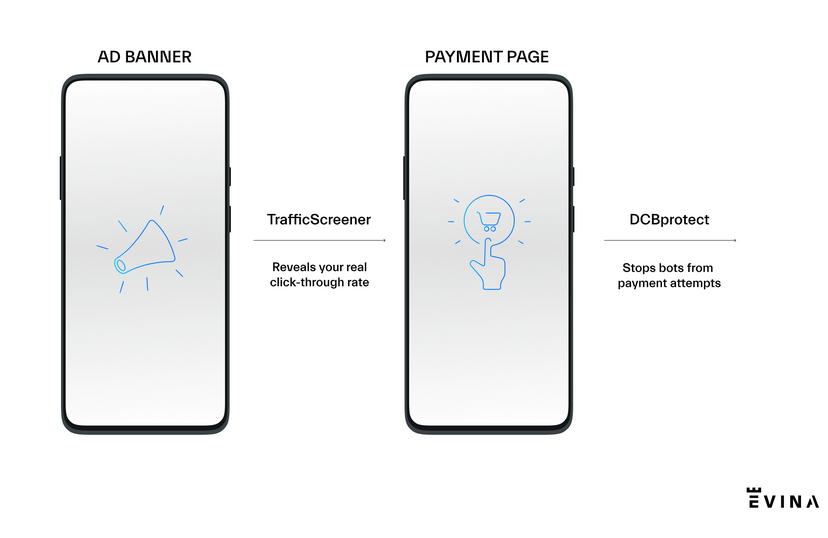

In this context, Vodacom has partnered with Evina to secure mobile transactions via Evina’s set of anti-fraud solutions that include DCBprotect and Eyewitness. DCBprotect detects bots that attempt to make fraudulent transactions whereas Eyewitness records fraudulent behaviour on payment pages to give proof to Vodacom’s partners of any bot-related activity.

Evina offers the most advanced cybersecurity technology for mobile payments and currently blocks over 16 million transactions in more than 70 countries worldwide. Evina is a recognized player in the mobile ecosystem and has been awarded various prestigious accolades such as the Best Financial Clearing Solution from Juniper Research and Best Carrier Billing Fraud Solution at the Global Carrier Billing Summit 2020.

David Lotfi, CEO & Founder of Evina: “We strive to work with mobile players that share our vision of fraud being a serious issue that needs to be dealt with – and soon. By integrating our anti-fraud solution into its operations, Vodacom with its large African network of mobile users, has confirmed that it too shares our values and wishes to create a fraud-free mobile payment ecosystem. This makes deploying the best technology worldwide, for the protection of South African mobile users, effortless.”

“The protection of our customers against all forms of fraudulent activity is our top priority. We are constantly striving to eradicate any potential mobile fraud on our network by updating and enhancing our controls to give customers peace of mind whilst enjoying seamless connectivity through their mobile phones. Introducing DCBprotect as solution is testament to our efforts to stay ahead of fraudsters and create a fraud free digital environment. We believe that early detection and blocking of any form of criminality on our network is in the interest of our customers and ultimately the Vodacom brand” said Mariam Cassim Chief Officer of Vodacom Financial and Digital Services.